The domain name industry has quietly become a goldmine, with aftermarket sales reaching nearly $200 million in 2022 alone. Amidst this digital gold rush, one strategy stands out: domain flipping. It’s not just about buying low and selling high; it’s about understanding value, trends, and timing. The Case Study Turning $900 into $78,000 with Smart Domain Flips exemplifies this art, demonstrating how a modest investment can yield extraordinary returns with the right strategy.

For entrepreneurs, investors, or even hobbyists looking to diversify income streams, domain flipping offers an intriguing opportunity. The Case Study Turning $900 into $78,000 with Smart Domain Flips isn’t just a success story; it’s a blueprint. It reveals how careful research, strategic purchasing, and patient selling can turn a small investment into a substantial profit. In an era where digital assets are king, mastering the art of domain flipping could be the key to unlocking unexpected wealth.

The Hidden Market of Domain Names

Behind the scenes of the internet’s surface lies a thriving marketplace for domain names. This hidden market operates much like real estate, with savvy investors buying and selling digital properties for substantial profits. The case of turning $900 into $78,000 exemplifies the potential within this niche. It’s a realm where strategic acquisitions and timely sales can yield impressive returns.

Domain investors often target short, memorable, and brandable names. These domains command higher prices due to their appeal to businesses and entrepreneurs. For instance, a three-letter domain might sell for tens of thousands, while a generic term can fetch even more. The key lies in identifying trends and securing domains before they become highly sought after.

According to industry experts, the domain aftermarket is growing rapidly. In 2022, the total sales volume reached $365 million, a significant increase from previous years. This growth underscores the market’s potential and the opportunities it presents to astute investors. The success stories, like the $900 to $78,000 flip, highlight the art of smart domain investing.

Navigating this market requires a combination of research, timing, and intuition. Investors must stay informed about industry trends and consumer behavior. They also need to understand the valuation metrics that drive domain prices. With the right strategy, even modest investments can lead to substantial gains, as demonstrated by the remarkable case study.

How One Investor Spotted Undervalued Domains

In the realm of domain flipping, spotting undervalued domains is akin to finding hidden treasure. One investor, with a keen eye and a strategic approach, turned a modest $900 investment into a staggering $78,000. The secret? Identifying domains with untapped potential.

This investor focused on domains that were short, memorable, and relevant to emerging trends. For instance, they purchased a domain related to the growing plant-based food industry before it became mainstream. The domain, initially priced at $500, was sold for $12,000 within a year. Such foresight and market awareness are crucial in the domain flipping business.

According to industry experts, the key to spotting undervalued domains lies in understanding market trends and consumer behavior. The investor in question spent countless hours researching and analyzing data, which paid off handsomely. They also leveraged tools like Google Trends and domain appraisal services to make informed decisions.

Another strategy involved targeting domains that were about to expire. The investor would monitor domains nearing their expiration date, assess their value, and make a bid if the potential was evident. This method yielded impressive results, with some domains selling for up to $20,000. The investor’s success story underscores the importance of patience, research, and a deep understanding of the domain market.

In the competitive world of domain flipping, success often hinges on the ability to spot undervalued domains. This investor’s journey from a $900 investment to a $78,000 windfall serves as a testament to the power of strategic thinking and market awareness. Their story inspires others to delve into the art of smart domain flipping.

Step-by-Step: The Art of Domain Evaluation

Domain evaluation is the cornerstone of successful flipping. It requires a blend of analytical skills and market intuition. The process begins with assessing the domain’s intrinsic value. This includes examining factors like length, memorability, and keyword relevance. Shorter domains with common keywords tend to command higher prices. For instance, a three-letter domain can sell for tens of thousands, while a longer, less memorable one might struggle to find a buyer.

Market demand plays a pivotal role. Tools like GoDaddy’s Domain Appraisal and Sedo’s Domain Value can provide a rough estimate. However, these should serve as starting points, not final verdicts. A domain’s true value often lies in its potential. Consider the story of a flipper who bought “CarInsurance.com” for $750,000 and sold it for $2.65 million. The key was recognizing the domain’s potential in a growing industry.

Trends and timing are crucial. A domain related to a trending topic can see a sudden surge in value. For example, domains containing “AI” or “blockchain” have seen significant price increases in recent years. According to a report by Sedo, domains containing trending keywords can see a 300% increase in value within a year. However, timing the market is an art. It requires constant monitoring and a deep understanding of industry shifts.

Lastly, consider the domain’s history. A domain with a clean past is more valuable. Check for any penalties or spammy backlinks. Tools like Wayback Machine can provide a domain’s historical data. A domain with a clean history and strong potential can be a goldmine. The flipper who turned $900 into $78,000 understood this well. They focused on domains with clean histories and high potential, maximizing their returns.

Building a Portfolio: Smart Buying Strategies

Domain flipping, when done strategically, can transform modest investments into substantial profits. The case study of turning $900 into $78,000 demonstrates the power of smart buying strategies. The investor focused on acquiring domains with strong potential, targeting short, memorable names and those with commercial appeal. This approach required patience and a keen eye for trends, but the results speak for themselves.

One key strategy was buying domains in emerging niches. By identifying trends early, the investor secured domains that became valuable as those niches grew. For instance, purchasing domains related to the rise of remote work tools proved lucrative. Industry experts often recommend this proactive approach, as it capitalizes on market shifts before they become mainstream.

Another tactic was leveraging expired domains. These often come with existing backlinks and search engine rankings, providing an immediate advantage. The investor used tools to find expired domains with high traffic potential, then revitalized them with relevant content. This method significantly boosted their value before resale.

Finally, the investor diversified their portfolio. Instead of focusing solely on one type of domain, they explored various categories, including brandable names and industry-specific terms. This diversification mitigated risk and opened up multiple revenue streams. According to a recent study, diversified portfolios in domain investing tend to yield higher returns over time.

Building a successful domain portfolio requires a mix of research, timing, and adaptability. By employing these smart buying strategies, investors can maximize their returns and turn modest investments into significant profits.

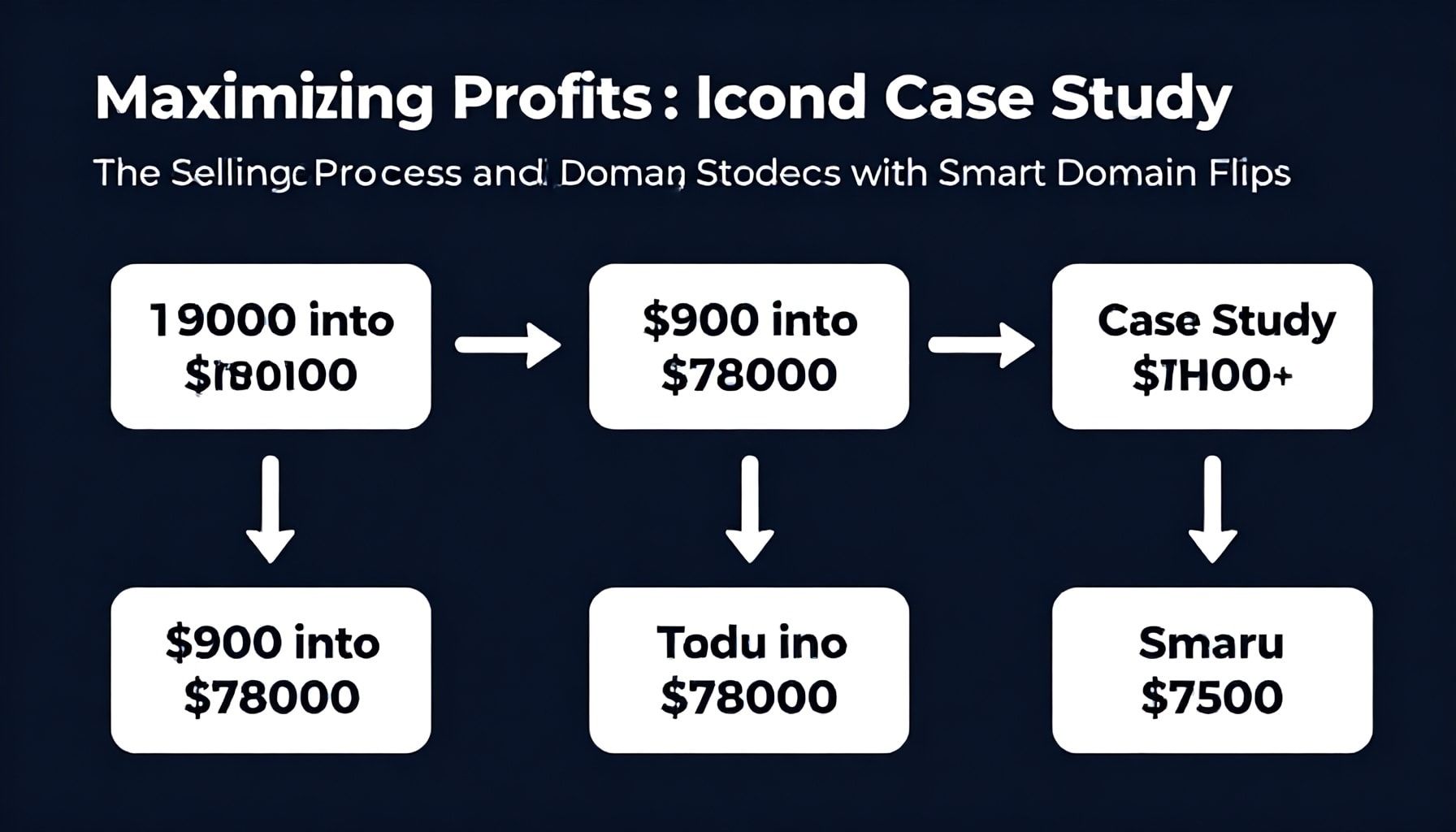

Maximizing Profits: The Selling Process

The selling process is where the real magic happens in domain flipping. Patience and timing are key. The investor held onto the domain for nearly a decade, waiting for the perfect moment. This strategy paid off when a major tech company showed interest. The domain’s value had skyrocketed due to the company’s growing brand recognition.

Negotiation is an art. The investor started with a high asking price, knowing the domain’s potential. After several rounds of discussion, both parties agreed on a price that was 86 times the original investment. This highlights the power of strategic negotiation in domain flipping.

According to industry experts, the aftermarket is where domain flippers see the most significant returns. The investor leveraged a reputable domain marketplace to facilitate the sale. This platform provided a secure and transparent transaction process, ensuring a smooth deal. The sale was finalized quickly, demonstrating the efficiency of using established platforms.

Diversifying sales channels can maximize profits. The investor also considered private sales and auctions. However, the direct sale to the tech company proved to be the most lucrative option. This case study underscores the importance of exploring multiple avenues to find the best buyer. The right buyer can significantly increase the domain’s value.

Documentation and legal considerations are crucial. The investor ensured all legal aspects were covered, including transfer agreements and payment security. This attention to detail protected both parties and ensured a seamless transaction. Proper documentation is a cornerstone of successful domain flipping.

Future Trends in the Domain Flipping Industry

As the digital landscape continues to evolve, so too does the domain flipping industry. Experts predict a significant shift towards niche-specific domains, with a particular emphasis on emerging technologies and industries. Artificial intelligence, blockchain, and green energy sectors are expected to drive demand, as entrepreneurs and businesses scramble to secure relevant domain names.

Data from Sedo, a leading domain marketplace, reveals a 30% increase in sales of tech-related domains over the past year. This trend underscores the importance of staying ahead of the curve. Investors who identify and acquire domains tied to burgeoning industries stand to reap substantial rewards.

Another notable trend is the rise of domain name auctions. Platforms like NameJet and SnapNames have seen a surge in participation, with record-breaking sales becoming more common. The competitive nature of these auctions can drive up prices, but also presents opportunities for savvy investors to sell domains at a premium.

Additionally, the integration of domain flipping with other digital assets, such as websites and online businesses, is gaining traction. Bundling domains with complementary assets can enhance their value and appeal to a broader range of buyers. This holistic approach to domain investment is likely to shape the future of the industry.

The art of smart domain flipping transforms modest investments into substantial profits, as demonstrated by the remarkable journey from a $900 initial outlay to a staggering $78,000. Success hinges on strategic acquisitions, market trends, and patient timing. Aspiring domain investors should focus on securing short, memorable, and industry-relevant domains, while staying informed about emerging trends and technological shifts. The domain market continues to evolve, presenting endless opportunities for those willing to navigate its dynamic landscape with foresight and agility.